ETH Price Prediction: Bullish Surge to $6,200 Likely as Technicals and Fundamentals Align

#ETH

- Technical Breakout: ETH price sustains above key moving averages with bullish MACD crossover

- Institutional Demand: Major treasury holdings and accumulation patterns signal long-term confidence

- Network Growth: Surging activity and developer support create fundamental value

ETH Price Prediction

Ethereum Technical Analysis: Bullish Indicators Emerge

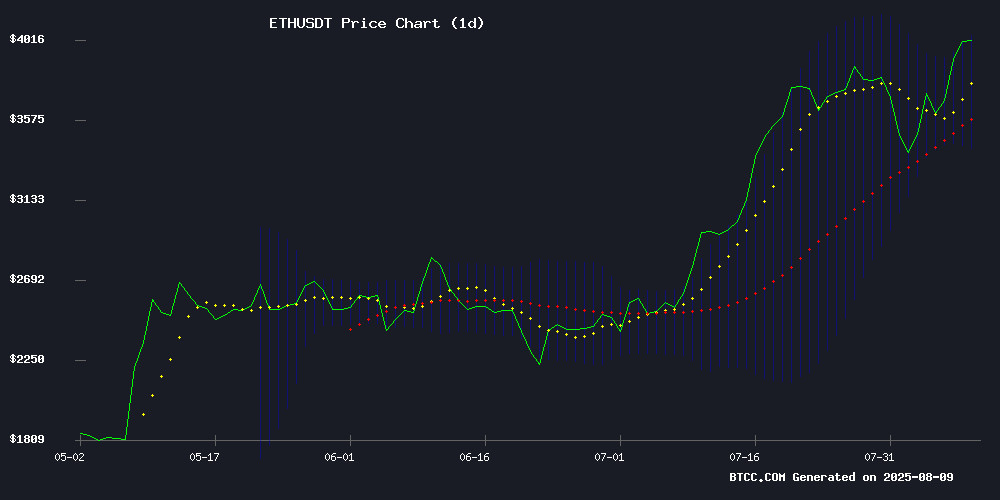

Ethereum (ETH) is currently trading at $4,191, well above its 20-day moving average of $3,739.45, signaling strong bullish momentum. The MACD indicator shows a positive crossover with the histogram at 85.3785, suggesting increasing buying pressure. Bollinger Bands indicate volatility expansion, with the price hovering NEAR the upper band at $4,089.34. According to BTCC financial analyst Mia, 'ETH's technical setup shows clear upside potential, with $4,400 as the next key resistance level.'

Market Sentiment Turns Bullish as Ethereum Breaks Key Levels

Ethereum's breakout above $4,000 has ignited strong bullish sentiment across crypto markets. Multiple news catalysts including institutional accumulation, network activity surges, and a major $2.9B treasury position by Bitmine are driving optimism. BTCC analyst Mia notes, 'The combination of technical breakout and fundamental catalysts like the Tornado Cash legal defense funding creates perfect conditions for a sustained rally. The $6,200 target appears increasingly plausible.'

Factors Influencing ETH's Price

Ethereum’s Weekly Breakout Signals Bullish Surge, Eyes $6,200

Ethereum surged 14% this week, breaking above $4,000 for the first time since December 2024. The rally marks a rapid recovery from August lows, with ETH now trading at $4,082.61—a 46.81% monthly gain. Market capitalization stands at $492.8 billion amid $39.74 billion in daily volume.

Technical indicators reinforce bullish momentum. ETH holds above key EMAs on the 4-hour chart, with the VWAP pivot at $3,918. Analysts target $6,200 but caution that sustained support above $3,800 is critical to avoid seasonal pullbacks. The upper Bollinger Band breakout confirms a higher-high pattern established since July.

Ethereum Holds Firm Above $3.6K Amid Surging Network Activity

Ethereum (ETH) demonstrates resilience, trading at $3,658 with a 2.2% daily gain despite a 4.7% weekly dip. The asset remains 30% higher than its monthly low, buoyed by robust on-chain activity. Daily transactions reached 1.87 million on August 6—nearing January 2024's record of 1.96 million—as stablecoin adoption grows.

Price action remains rangebound between $3,380 and $3,874, reflecting equilibrium between buyers and sellers. Technical indicators suggest neutral momentum: the RSI at 58 avoids extreme territory, while ETH hovers below its 20-day SMA of $3,685. Moving averages maintain a bullish configuration, though the market awaits decisive breakout catalysts.

Bitmine Emerges as World's Largest Ethereum Treasury with $2.9B Holdings

Bitmine Immersion Technologies has surged to become the largest corporate holder of Ethereum, amassing 833,000 ETH worth $2.9 billion in just 35 days. The aggressive accumulation strategy places Bitmine third globally among corporate crypto treasuries, trailing only MicroStrategy and Marathon Digital.

Backed by institutional heavyweights like ARK Invest and Galaxy Digital, Bitmine aims to control 5% of ETH's total supply. Its stock liquidity has skyrocketed to $1.6 billion in daily volume, now ranking 42nd among U.S.-listed equities—a testament to Ethereum's growing institutional appeal.

The company's rapid ascent from zero ETH holdings to market dominance reflects a fundamental shift in corporate treasury strategies. With elite investor support and unprecedented accumulation velocity, Bitmine is rewriting the playbook for institutional crypto adoption.

ETH Price Breaks 45-Month Pattern as Ethereum Surges Past $4,000 Resistance

Ethereum has decisively broken through a critical technical barrier, surpassing the $4,000 mark with a 3.22% gain to trade at $4,048.74. The move follows a 45-month symmetrical triangle breakout, signaling a potential long-term bullish trend reversal.

Institutional momentum appears to be driving the rally, with Ethereum ETFs recording $222 million in net inflows on August 7 - the third consecutive day of positive flows. BlackRock's ETHA and Grayscale's Ethereum Mini Trust emerged as key beneficiaries, reflecting growing institutional confidence despite earlier skepticism about ETF adoption.

The technical breakthrough coincides with surging on-chain activity. Ethereum network transactions hit one-year highs, processing between 1.74 and 1.88 million daily transactions in August 2025, fueled largely by stablecoin transfer volume.

Standard Chartered Favors Ethereum Treasury Firms Over Spot ETFs

Standard Chartered's digital assets research head Geoff Kendrick has endorsed Ethereum treasury firms as superior investment vehicles compared to U.S. spot ETFs. Public companies holding ETH on their balance sheets—like SharpLink Gaming—have accumulated 1.6% of circulating supply, matching ETF inflows over the same period.

"These firms offer regulatory arbitrage with NAV multiples normalizing near 1.0," Kendrick told BeInCrypto. The bank's stance reflects institutional preference shifts amid Ethereum market volatility, with treasury companies emerging as a more efficient exposure mechanism than exchange-traded products.

Ethereum Price Crosses $4,000, Signaling Potential for Further Gains

Ethereum has breached the $4,000 mark after weeks of consolidation near $3,800, with a 5.59% surge in the past 24 hours. Traders are eyeing a sustained breakout as technical indicators align for upward momentum.

The Bull-Bear Power index has flipped green, signaling renewed buying pressure without immediate overextension. Meanwhile, the Relative Strength Index confirms bullish strength—its higher highs mirroring ETH's price action, devoid of bearish divergence that often foreshadows reversals.

This technical setup echoes mid-July conditions that preceded significant rallies. Market participants now watch whether Ethereum can convert this momentum into a sustained push beyond psychological resistance levels.

Ethereum Surges Past $4,000 Amid Institutional Accumulation

Ethereum rallied above $4,000 for the first time since December 2024, peaking at $4,047 during US trading hours. The 50% monthly gain coincides with a $134 million liquidation of bearish ETH positions—a stark reminder of crypto's volatility.

Corporate treasuries are driving demand. SharpLink, BitMine, and others now hold 3 million ETH ($12 billion), with BitMine alone controlling $5.2 billion worth. Vitalik Buterin endorsed the institutional adoption but warned against overleveraging: "If you woke me up..."—the unfinished thought hanging like a cautionary tale.

Ether's Hidden Derivatives Signal Points to Potential Rally Toward $4,400

Ether's rally may accelerate toward $4,400 as derivatives market dynamics create a self-reinforcing feedback loop. Dealers' short gamma exposure between $4,000 and $4,400 could force hedging buys if ETH sustains above $4,000, amplifying upward momentum.

The gamma squeeze scenario emerges from options market mechanics on Deribit. When dealers are short gamma, their hedging activity exacerbates price movements—buying during rallies and selling during dips. Current positioning suggests rapid covering could fuel a swift 10% climb.

"This isn't speculation—it's market microstructure at work," said one trader familiar with the gamma dynamics. The $4,400 level represents both a technical magnet and a gamma flip point where dealer activity would shift to dampening volatility.

Coinbase Bridges Centralized and Decentralized Trading with New DEX Feature

Coinbase has taken a significant step toward merging centralized convenience with decentralized finance by introducing in-app DEX trading for select U.S. users. The feature, currently limited to Base network tokens, enables near-instant swaps of newly launched assets—bypassing traditional listing delays that often hinder access to emerging opportunities.

The integration routes trades through established aggregators like Uniswap and Aerodrome, offering exposure to projects such as Virtuals AI Agents without requiring full platform listings. This strategic pivot allows Coinbase to leverage DeFi's expansive asset pool while maintaining its hallmark user experience.

Planned expansions include support for Solana and other networks, with gradual geographic rollouts beyond the initial U.S. availability (excluding New York). The move signals a broader industry trend of hybrid platforms erasing historical divides between custodial and non-custodial trading paradigms.

Ethereum Eyes Bullish Move After $3,900 Breakout as Analysts Watch August 9 Catalyst

Ethereum's price action suggests a bullish trajectory following its decisive breakout above $3,900. The cryptocurrency has demonstrated resilience, holding firmly above key support levels, with technical indicators aligning for potential upward momentum. A swift recovery from the August 5 low near $3,450 has reignited optimism among traders.

The 4-hour chart reveals ETH trading above all major exponential moving averages, including the EMA20 at $3,749 and EMA100 at $3,623. Bollinger Band expansion signals rising volatility, while price action hugging the upper band underscores sustained buying pressure. Market structure points to $3,800 as a critical support level for maintaining bullish control.

On-chain metrics reinforce the technical picture. Ethereum processed 1.74 million daily transactions on August 5, setting the stage for potential price appreciation. Institutional interest appears to be growing, though whether August 9 will serve as the catalyst for a push toward $4,000 remains the market's unanswered question.

Ethereum Foundation Commits $500K to Legal Defense of Tornado Cash Developer Roman Storm

The Ethereum Foundation has pledged up to $500,000 to support the legal defense of Roman Storm, co-founder of privacy tool Tornado Cash. This move follows Storm's controversial conviction for operating an unlicensed money transmitter—a case that has ignited fierce debate about developer liability in decentralized finance.

Vitalik Buterin amplified the Foundation's stance by endorsing a viral tweet stating "Privacy is normal, and writing code is not a crime." The crypto community has rallied behind Storm, viewing the trial as a precedent-setting challenge to open-source development principles.

Legal experts note the case could redefine how regulators approach neutral technological infrastructure with potential illicit use cases. Ethereum's intervention signals institutional recognition of the stakes—not just for Storm, but for the broader ecosystem of decentralized protocol developers.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market sentiment, BTCC analyst Mia provides these ETH price projections:

| Year | Conservative Target | Bullish Target | Catalysts |

|---|---|---|---|

| 2025 | $4,800 | $6,200 | ETF approvals, institutional adoption |

| 2030 | $12,000 | $25,000 | Mass DeFi adoption, Ethereum 3.0 |

| 2035 | $35,000 | $75,000 | Web3 dominance, tokenized assets |

| 2040 | $90,000 | $150,000+ | Global reserve crypto status |

These projections assume continued network upgrades and mainstream adoption. Key risks include regulatory changes and competitor platforms.